Getting The Small Business Accounting Service In Vancouver To Work

Wiki Article

The Of Vancouver Tax Accounting Company

Table of ContentsSmall Business Accounting Service In Vancouver Can Be Fun For EveryoneThe Greatest Guide To Cfo Company VancouverThe 2-Minute Rule for Small Business Accounting Service In VancouverThe Basic Principles Of Vancouver Tax Accounting Company

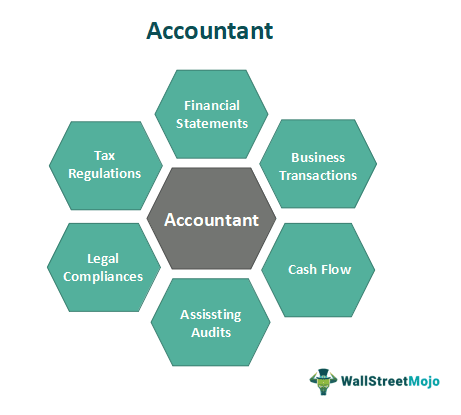

This area is an extremely vital location where services often require recommendations from outdoors experts. Certified public accountants can offer recommendations and also offer execution help in evaluating and picking new audit as well as functional software program remedies. They can assist organizations develop job groups to work with executing brand-new accountancy requirements like leases, earnings recognition, as well as credit scores losses that need considerable changes in how money departments account for these purchases.Certified public accountant firms can audit a business's monetary statements, which may be needed by lenders, federal government grants, or investors. Audited monetary statements give assurance that the economic declarations are relatively specified as well as follow GAAP. outsourced CFO services. Certified public accountants may likewise offer audits of a firm's inner control over economic coverage. Another solution CPAs can provide pertaining to economic statements is collection or evaluation.

In a compilation, the CPA does not offer assurance on the accuracy of the economic statements yet reads them and also takes into consideration whether they appear proper in form as well as are totally free from evident material misstatements. In a testimonial, the CPA carries out analytics, asks question, as well as carries out other treatments to acquire limited assurance on the financial declarations.

Company owner need to consider their present and also near-term needs from a CPA. Many Certified public accountants would certainly more than happy to discuss your requirements and just how their firms can (or can not) offer those services, along with the costs they will charge, so you can discover a CPA that you are comfortable dealing with. small business accountant Vancouver.

The Definitive Guide for Outsourced Cfo Services

A small company could have short-term payments to financial institutions. Tax obligation preparation and also declaring isn't enjoyable however it's critical to make certain whatever is handled appropriately.

As an example, will you need to prepare weekly or regular monthly financial reports or quarterly and also annual records? One more factor to think about is financial understanding. Exists a person in your office who is certified to deal with important bookkeeping and also accounting solutions? If not, an accountant might be your best bet.

What Does Tax Consultant Vancouver Mean?

Accounting professionals are quite flexible as well as can be paid per hour. Additionally, if you do decide to outsource audit and also bookkeeping services, you wouldn't be accountable for providing benefits like you would certainly for an internal worker. If you choose to employ an accounting professional or accountant, right here are a few ideas on finding the ideal one: Inspect recommendations and previous experience Make sure the candidate is educated in accountancy software application as well as innovation See to it the candidate is well-versed in accounting plans as well as procedures Test that the prospect can clearly communicate monetary terminology in words you comprehend Ensure the prospect is friendly and not a robotic Little business proprietors and entrepreneurs typically contract out accounting as well as accounting services.We compare the ideal here: Wave vs. Zoho vs. Quick, Books Do not forget to download our Financial Terms Cheat Sheet, which consists of important accounting as well as bookkeeping terms.

The bookkeeping occupation continues to really feel the effects of the modern technology disruption that has influenced all industries. That's great information for accountants who prepare on starting an accounting firm.

Just like any type of local business, developing an accountancy practice requires a large amount of job, yet as Thomson Reuters notes, bookkeeping companies BC are presently among the most successful of all local business. The best method to guarantee the success of a brand-new accounting business is to have a rock-solid plan that prepares the procedure to survive its critical initial year.

Vancouver Tax Accounting Company - Truths

Accounting professionals and also other experts are increasingly picking to work individually instead of as staff members. Finances Online reports that huge accounting companies are having a hard time to fill their employment opportunities as the unemployment price for accounting professionals floats around 2%. Nonetheless, not all accountants are eliminated to invest their job benefiting somebody else.Beginning any kind of service requires drive and also effort. Success additionally depends on the support of your household. Getting income calls for advertising skill to drum up consumers. The way to make the highest possible fees is by separating the company using a bookkeeping specialized, which needs its very own set of abilities as well as experience.

Few freelance accountants become their very own employers directly out of school. In nearly every case, they first acquire valuable work experience as an employee of an audit company.

Report this wiki page